It’s a trick (scam) that’s as old as time (see dinosaur cartoon below) and it’s been referenced in numerous books, tv shows and movies.

It goes like this. A collection of 1000 people are mailed, emailed, or otherwise informed of a prediction taking place at some point in the future. This might be the winner of a horse race, the winner of a sporting event or a stock / currency prediction.

500 of the lot are told to buy. The other 500 are told to sell. Either way, 500 people notice the correct prediction while 500 others notice a loss. The 500 who saw the correct prediction, move on to round two where a new prediction is made in the same fashion.

Again, 250 people see a correct prediction (now two in a row) while 250 others are discarded after a loss. And again… and again… and again. After eight rounds, the scammers are left with four people who have seen eight correct predictions in a row. Four people who have seen nothing but wins. Four people who developed a blind faith in the mailing prophet and are now prepared to risk far too much.

Trading Indicators

The core of the scam maybe different, but the mechanics are the same. With all so called indicators, whether it is a Bill Williams Fractal Indicator, the Elliot Wave Forecast or any other Forex Indicator the trouble is, they are subjective, each person will draw different conclusions from the same data. So just like with the above mentioned scam, you never know for certain whether there is a rational behind the signals you are getting.

A group of people will profit from the signals and that will nurture their belief in the indicator, while a different group of people will loose money but instead of loosing faith in the indicator, they will loose faith in their own ability to interpret the signal. So in a way, the ambiguity of the indicators makes it even harder to walk away from them than from the mailing prophet.

But the rational behind the “trading indicators,” is little more than:

1. Let’s tell Bob to buy Gold.

2. Let’s tell Steve to sell Gold.

There’s no rational for the advice and if rational is requested… it’s simply made up by yourself or the signal provider.

Bob: Why should I buy gold here?

Answer: It’s hitting support and has room to run.

Steve: Why should I sell gold here?

Answer: It’s resting on support and is going to break through.

Technical analysis is awesome! – oh wait.

Why do we bring this up?

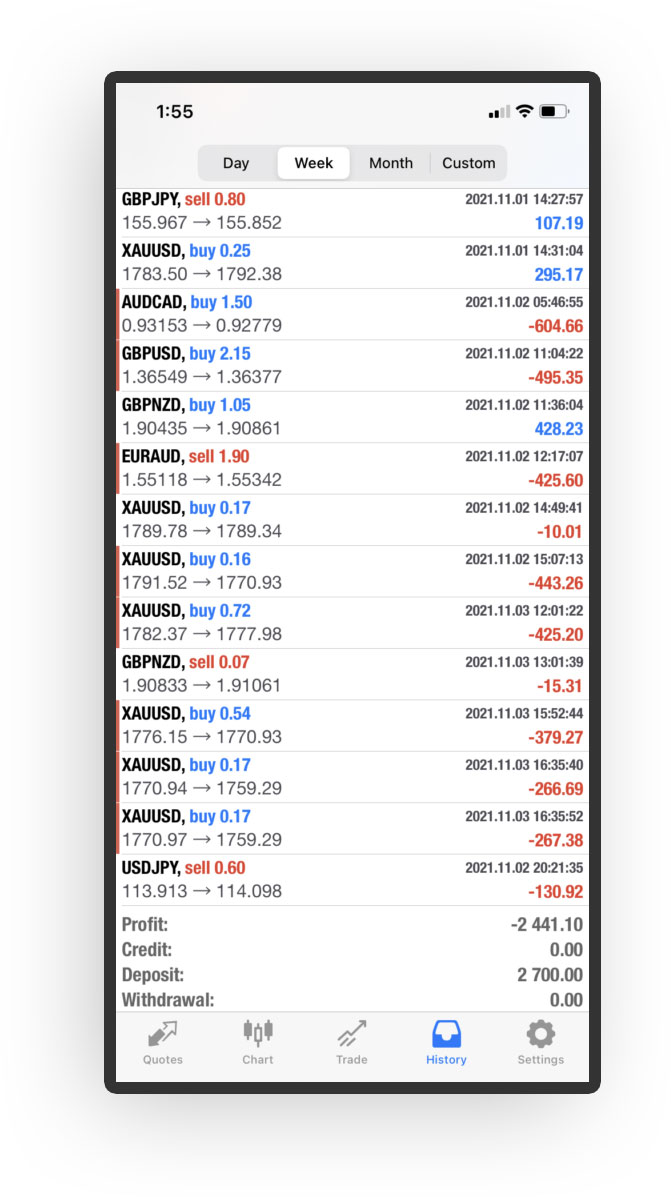

Because we’re confronted with the results of this nonsense on a daily basis. Below is a table of trades presented to us last week. It represents 14 trades provided by a free signal service over a three day period. Not only is every trade of a different size ranging from 2.15 to .07 lots… but none of the trades have any rational at all. It’s as if the provider said “Let’s buy Gold. Well, that didn’t work. Let’s do it again with a different size and see how that pans out.”

Over the years, we have been provided with pages and pages of screenshots just like this one and all of them look the same. Erratic trading with no rational or system and position sizing all over the place. There’s a very simple reason for that.

You and the other traders are receiving different signals at the same time. One is going to win and send more money. The other is going to lose and move on to the next free system. It’s an illusion. It’s a joke. It’s a scam.

A few weeks ago, we wrote a blog on unregulated brokers. First of all, never use an unregulated broker. The above example applies to brokerage firms offering trading advice. It applies to signal providers that recommend brokers for you to use. And it applies to free signal services that use the potential of profitable trades to lure you in to long term offers.

As directly as we can put it… if someone is offering you free trading or financial advice, it means they are not following the same advice for themselves. And it means they are likely telling trader #2 the exact opposite.

Don’t want to trade based on subjective indicators? Find out how fractalerts can simplify your trading at our Get Started page.

-

The rhytm beneath the noise

-

You Don’t Need a Trading Style. You Need an Edge.

-

Consistency Isn’t the Goal—It’s the Outcome

-

What 2 Quadrillion Data Points Told Us

-

Math and Physics-Based Trading in Any Market Condition

-

Do not worry about anomalies

-

Consistency should not be the goal. Consistency should be the result.

-

Stop canceling fridays

-

The Elliott Wave Forecast is Subjective, Bias Driven And Backwards looking

-

Finding patterns in market data