We haven’t stepped in it for a while… so let’s get this series of articles off with a bang.

In recent weeks, we have been told:

“I haven't been trading with the high volatility. Hope to join back up when things settle down some.”

“Given the market volatility I am staying away from the market for the time being.”

“but have been quite badly burned by the volatility recently”

“There is too much volatility in the market”

“This volatility is getting too difficult to gage the direction of the market”

“(The markets) are extremely volatile at present so (I am) extremely busy managing positions.”

We are well into the 4th quarter at this point and volatility is at the front of the minds of many traders. It’s a time of year when more volume enters the market. More news takes place with everyone back from vacation. And more traders look for reasons to make decisions on what direction the markets will close out the year.

These factors lead many traders to worry, focus on or otherwise concern themselves with volatility.

But what exactly is volatility? What impact does it have on the markets? And most importantly, what impact does it have on our programs, trades or results? (spoiler… none).

According to Merriam-Webster, volatility is “a tendency to change quickly or unpredictably.” This definition can be applied to many things… but in market terms, it’s a measure of “how big was the move today vs. how big was the move yesterday (or last week.. or last month, etc). A 10 point range yesterday followed by a 50 point range today means volatility is moving up. The reverse means volatility is moving down. A sudden shock to the markets such as an unemployment report or war breaking out or an Elon Musk tweet can cause either short term or longer term volatility.

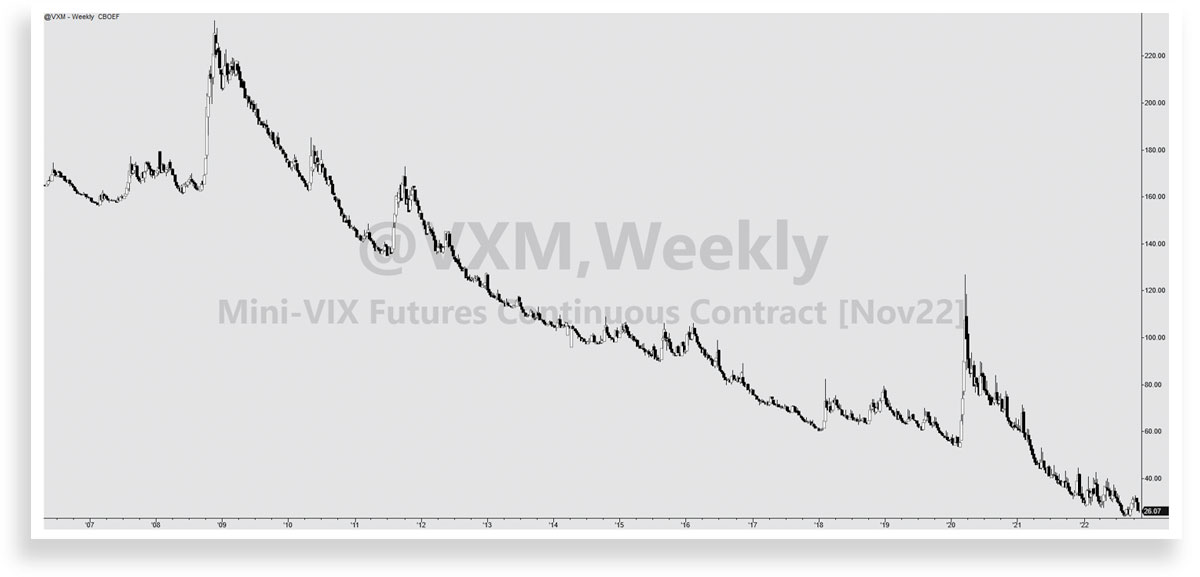

The most common measure of volatility is the VIX. It’s the CBOE’s index “representing the market’s expectations for volatility over the coming 30 days.” According to many of the comments we have received recently, one would conclude the markets are extremely volatile. Are they?

No. It’s at an all-time low. In fact, it’s so low, it would require a 900% increase in volatility to match the highs of 2008 (a time that was actually volatile). We remember those days quite well as we traded through them (very successfully we might add). So why do traders insist on suggesting the markets are very volatile? Why is volatility catching the blame and what is it being blamed for?

Well… if we can be blunt… it’s poor performance. Specifically, poor performance due to excessive risk and a poor trading strategy. That’s it. Volatility is just a way to deflect blame from what’s right in front of most traders… poor execution and gambling tendencies. Nothing more. Blaming volatility for poor performance is like blaming your dog for eating your homework you never did in the first place. Stop deflecting.

Here's the rub. Volatility (or market conditions in general) should have no impact on your decisions, ability to trade or ability to profit. If market conditions do have an impact, (just being blunt again), your trading strategy sucks should be revised.

When markets are quiet, volatility gets blamed for poor performance (i.e. not making enough). When markets are wild, volatility also gets blamed for poor performance (i.e. taking losses), but for opposite reasons. Let’s stop giving volatility a bad name and start calling it what it actually is… yesterday’s news.

If you’re looking for a trading strategy that doesn’t care at all about current or future market conditions (because they don’t matter) Fill in the form on our homepage and a member of our team would be happy to give you a call or engage via email. Follow our trades. Leave the math to us.

P.S. We have been told dozens of times that the 4th quarter is the most volatile. Well… taking an average price of the VIX for each of the last 16 years shows the 1st and 2nd quarters have higher average prices. A more extensive study would need to be done on every market we cover, but at least in this instance, the 4th quarter is rather quiet.

1st Quarter: 112.16

2nd Quarter: 109.63

3rd Quarter: 105.50

4th Quarter: 109.43

-

The rhytm beneath the noise

-

You Don’t Need a Trading Style. You Need an Edge.

-

Consistency Isn’t the Goal—It’s the Outcome

-

What 2 Quadrillion Data Points Told Us

-

Math and Physics-Based Trading in Any Market Condition

-

Do not worry about anomalies

-

Consistency should not be the goal. Consistency should be the result.

-

Stop canceling fridays

-

The Elliott Wave Forecast is Subjective, Bias Driven And Backwards looking

-

Finding patterns in market data