And yet, through it all, routines continue. Markets open. Data streams. Traders analyze. The system persists. This resilience raises an important question:

How can markets appear so chaotic while behaving with such consistency over time?

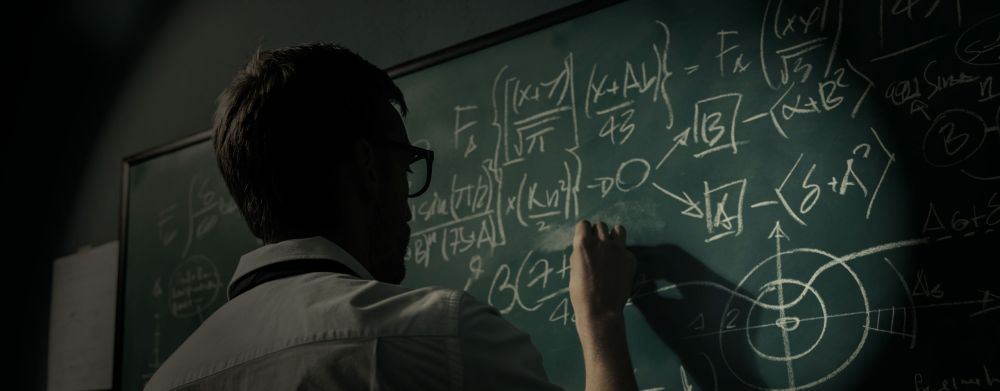

The answer lies in the foundations of chaos theory and the mathematics of repeating patterns.

Order Inside Uncertainty

Chaos theory studies systems that seem random but are governed by deterministic rules.

These systems are sensitive to initial conditions: the famous “butterfly effect”, but they are not without structure.

Embedded within their apparent disorder are fractals: repeating, self-similar patterns that emerge at multiple scales.

Fractals appear in coastlines, plant growth, cloud formations, and crystal structures.

But they also appear in places we rarely expect, such as price movements in financial markets.

These patterns can’t be recognized by looking at a chart. Their geometry is woven into vast amounts of data. Yet mathematically, they reveal themselves with surprising clarity.

Emotion: The Distortion Layer

If markets were purely rational machines, their movements might resemble clean, predictable sine waves. Cycles would expand and contract with mathematical regularity.

But markets are human ecosystems. They absorb our fear, optimism, hesitation, and overconfidence. This emotion introduces noise: short-term distortions that make markets look more erratic than the underlying structure truly is. And yet, time and again, we observe the same phenomenon:

-

Shocks occur.

-

Prices react.

-

Conditions stabilize.

-

Markets return to their underlying trajectory.

A disruptive event may cause a violent deviation, but rarely does it rewrite the long-term pattern entirely, much like a pothole jolts a car but doesn’t force it off the highway.

Finding Structure in the Data

To reveal hidden structure, quantitative analysts use mathematical tools such as Fourier transforms to break complex data into component frequencies.

This allows researchers to:

-

Separate signal from noise

-

Identify repeating cycles

-

Recognize fractal patterns across multiple timescales

-

Detect turning points that often precede visible trend shifts

The goal is not to predict news or external events. Instead, it’s to understand how the market behaves despite them. Markets, like weather systems, reorganize quickly after turbulence.

Their underlying patterns reassert themselves with remarkable reliability.

Signal, Noise, and the Role of Humility

Interpreting complex systems requires technical skill, but also restraint. As Nate Silver writes in The Signal and the Noise:

“Distinguishing the signal from the noise requires both scientific knowledge and self-knowledge: the serenity to accept the things we cannot predict, the courage to predict the things we can, and the wisdom to know the difference.”

Financial markets occupy this intersection. They are neither fully predictable nor fully random.

Instead, they reflect the constant tension between structure and disturbance, mathematics and human behavior.

Understanding them doesn’t eliminate uncertainty: it contextualizes it. It reveals that beneath the emotional surface, a deeper order is always present, waiting to be recognized.

Beneath the noise, the rhythm remains.

-

The rhytm beneath the noise

-

You Don’t Need a Trading Style. You Need an Edge.

-

Consistency Isn’t the Goal—It’s the Outcome

-

What 2 Quadrillion Data Points Told Us

-

Math and Physics-Based Trading in Any Market Condition

-

Do not worry about anomalies

-

Consistency should not be the goal. Consistency should be the result.

-

Stop canceling fridays

-

The Elliott Wave Forecast is Subjective, Bias Driven And Backwards looking

-

Finding patterns in market data