Advanced options trader crash course

This week will be very different. We’re going deep. We’re going to get into the Greeks, Black-Scholes and even Gauge theory (again). Options are incredibly complicated instruments and we’re going to show you why. Who has their whiskey ready?

We started the discussion on options trading because of the frightening amount of emails we receive every day referring to options trading. Some of these traders have an enormous amount of experience with options. They know how to trade them. They know how to hedge risk and they know how to take a loss while moving on to the next trade. These blogs, while interesting, are not directed at you (points finger).

These blogs are for those of you who have seen options as the last line of defense in your trading. These blogs are for those of you who see options as a way to recover major losses. Or a way to continue trading even though all other strategies you have tried have not worked. These blogs are meant to show you why that’s a very… very bad idea.

Black-Scholes – pricing options

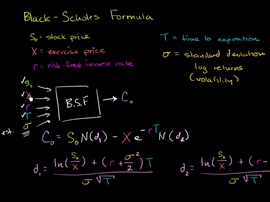

For the last 70 years, the Black-Scholes model has been the primary means by which complex derivatives are priced based on potential returns and risk of the underlying market, vs. the risk of doing nothing at all… or holding cash.

The Black-Scholes equation is considered to be a partial differential equation which considers Time, current price (spot), strike, risk free rate and volatility. We’re going to get into volatility as a measure to consider at a later date, but these factors combined into a cumulative distribution function result in an option’s price determined to be the fair market value at that time.

In short, if you think the fair market value is underrated, you might buy a call. If you think the fair market value is overrated, you might buy a put. Or you may use any number of ultra complicated methods we mentioned last week in order to take advantage of that mispriced option you’re looking at.

As an aside, it was the Black-Scholes equation (or the application of that equation) that led to the collapse of LTCM in 1997. So… there’s that.

The Greeks – the change of price of options

Delta, Gamma, Vega, Theta and Rho. These nasty little formulas are the reasons options change price… and how they change.

Theta, for example, refers to time decay. A 30 day option in a market that is not moving at all is going to decay at an accelerating rate for every day the market fails to move in your direction. The longer the market takes to move, the stronger Theta gets and thus the larger move you’re going to need in the end.

It is a bit like falling towards a black hole. The closer you get to the event horizon (expiration date), the stronger the propellent force you need in order to escape spaghettification. Theta = gravity.

When your financial instrument can be compared to “death by black hole”… something isn’t right.

Delta is the rate of change while Gamma is the rate of change of the rate of change. Often people confuse these with market volatility, but really they’re just referring to how fast the underlying market is moving relative to the moment before. A market that climbs steadily over a period of 10 days may be advancing, but at a delta of 1 and a gamma of zero (i.e. it is not getting stronger, the market is steady). Steady markets lead to options price depreciation and thus a need to advance quickly near the end. But then… gravity and spaghettification and all that.

Rho is much the same, but it’s comparison is the risk free environment.

The Greeks are important and necessary factors when looking at any instrument with oscillating prices. But in options trading, the Greeks are largely out to get you unless you know exactly what they mean, how they impact what you are trading and why.

Gauge theory – comparing one opportunity to another

Ok… first, you should probably start here and then come back.

Gauge theory applied to options prices will give anyone a headache. And that’s what we aim to do now.

“In this framework the net present value (NPV) calculation and asset exchanges are interpreted in geometrical terms as parallel transports in some sophisticated bre bundle space. This allows us to map the capital market theory to a theory similar to electrodynamics and then use the machinery of quantum field theory. It was shown that the free quantum gauge theory is equivalent to the assumption of log-normal walks for assets prices.”

Kirill Ilinski and Gleb Kalinin – CERN

Gauge theory and specifically Gauge theory applied to arbitrage is how institutions and algorithms price, evaluate risk and trade options. They use the risk free rate as the Lagrangian while making comparisons between the options you’re evaluating with millions of other options. When you click the button to buy, these formulas seek to compare the quoted price with billions of other possibilities before agreeing to sell you that option or pass on the opportunity.

In short, when you click buy, you are very likely purchasing an option these computers have determined to be appropriately priced for a valueless expiration.

Options are all about comparing one opportunity to the next and Gauge theory represents the formulas designed to make comparison. Gauge theory is the math behind the curtain.

It’s complicated. It’s why the option you are trading costs $1.56 instead of $1.34. And it’s why 99% of all traders using options lose money.

What does this mean to an aspiring options trader?

In short, know what you are trading. It’s not enough to look at the market, form an opinion and put money into an instrument and then hope for an enormous return (we just described the lottery). Educate yourself on the risk and reward potential of each instrument, how they work for and against you and have a plan. Always have a plan.

If you don’t, you shouldn’t be an options trader because the institution (almost always an institution) or the computer algorithm that is selling you that option understands all of this very well… and have determined you’re wrong.

-

The rhytm beneath the noise

-

You Don’t Need a Trading Style. You Need an Edge.

-

Consistency Isn’t the Goal—It’s the Outcome

-

What 2 Quadrillion Data Points Told Us

-

Math and Physics-Based Trading in Any Market Condition

-

Do not worry about anomalies

-

Consistency should not be the goal. Consistency should be the result.

-

Stop canceling fridays

-

The Elliott Wave Forecast is Subjective, Bias Driven And Backwards looking

-

Finding patterns in market data